GREEN HILLS TELEPHONE CORPORATION

Welcome to the Member Portal

At Green Hills Communications, we operate as a cooperative – meaning we work for you, the member. And at the heart of everything we do is a deep commitment to you and your community. As a proud member of our cooperative, you’re more than just a customer—you’re an owner. This exclusive portal is designed to keep you informed, connected, and engaged.

Who are cooperative members?

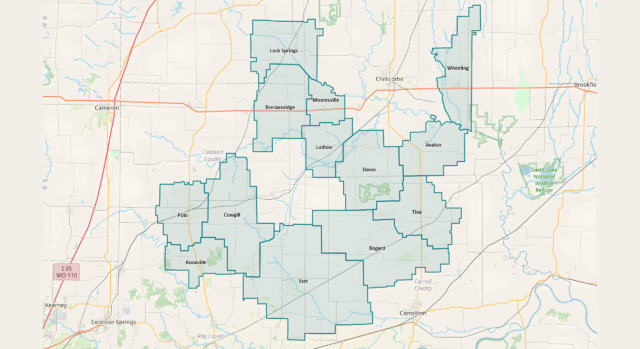

If you live in one of the following original Green Hills Telephone exchanges (Avalon, Bogard, Breckenridge, Cowgill, Dawn, Knoxville, Lock Springs, Ludlow, Mooresville, Polo, Stet, Tina or Wheeling), pay your one-time $5 membership fee, and establish service with us then you are automatically a member of the Green Hills Cooperative. The cooperative territory is divided up into six districts: District 1 – Breckenridge & Lock Springs, District 2 – Mooresville, Ludlow, & Wheeling, District 3 – Avalon & Tina, District 4 – Dawn & Bogard, District 5 – Stet & Cowgill, and District 6 – Knoxville & Polo. The cooperative is served by a board of directors elected by the membership. There is one representative elected from each district, plus three at-large.

Board of Directors

David Misel, President | District 6

Roy Thomas, Vice President | District 2

Jeff Riley, Secretary | District 1

Lee Moritz | District 3

Phil Griffith | District 4

Willard Wood | District 5

Curt Shonk | District 1 At-Large

Carolyn Shaffer | District 2 At-Large

Bill Gilliland | District 3 At-Large

What are the benefits of membership?

- Ownership: Members are more than just customers – they are part owners. When the cooperative does well, they get to share in the success. A portion of what they pay in is returned to them through capital credits.

- Participation: Members have a voice in how the cooperative operates by voting on their board members and any changes made to the bylaws.

- Community Investment: Members are expressing support for their community by being a part of Green Hills Communications – a community-based business who is investing in their families & communities.

How do capital credits work?

As a valued member of Green Hills Telephone, you automatically earn capital credits each year. There are three stages to the capital credit process (Allocation, Retirement, Unclaimed) This whole process helps support long-term investments in our network, ensuring a reliable service for all our members and strengthening the cooperative for today and the future.

Allocation Stage: A portion of the cooperative’s surplus revenue is allocated to your account based on the services you purchase. The more services you subscribe to, the more capital credits you accumulate — it’s our way of returning value back to you. These funds are returned to you at a later date during the retirement stage.

Retirement Stage: After our annual financial review, if Green Hills Telephone has funds exceeding normal operating expenses and is financially able, the Board of Directors may approve to refund a portion of the capital credits allocated to members. This decision ensures we maintain a healthy financial position while returning value to our members. This will come to you as a bill credit or a check typically in November.

Unclaimed Stage: Unclaimed capital credits are funds that were retired to a co-op member but couldn’t be delivered—usually because the member moved without updating their address or has passed away and didn’t have a beneficiary on file. If a capital credit check is returned to us as undeliverable, we research the account and try to contact the member. If we’re unable to reach them, and the check remains uncashed, those funds may eventually be classified as unclaimed and be redistributed among current co-op members.

Protect your capital credits!

· Keep your mailing address up to date in our system

· Complete a beneficiary form

· Contact us anytime if you have questions – we’re here to help.

View the Capital Credits informational brochure HERE.

Thank you for being a valued member! Your participation helps keep Green Hills communications strong, local, and member focused. We truly appreciate your continued support of our cooperative and look forward to serving you—now and in the years to come.

Sherryl Garcia, Membership Coordinator • 800-846-3426

Member FAQs

When will I receive my capital credits?

Capital credits may not be distributed to you every year. Since the distribution is based on prior years of operation, you may only receive a refund when the Board of Directors approves the retirement of capital credits from specific year when you had service. These years may not be consecutive, and the amount retired can vary depending on the cooperative’s financial position. Capital credit checks are typically mailed out in November. When you receive a capital credit check, it can be cashed or deposited just like any other check.

Allocation of capital credits will occur between July and September. Prior to the distribution of capital credits, any unclaimed capital credits from the previous year will be published in October. Capital Credit refunds of current members will be distributed in November, by being mailed to the most current address on file. If your allocation amount is $20 or less it will show up as a bill credit on either the October or November bill for current customers.

Why are my neighbor’s capital credit checks larger than mine?

Capital credit refunds are unique to each member and depend on several factors, including how many services the member has subscribed to, how long they’ve been a member of the cooperative, and which year(s) the Board of Directors have chosen to retire. These differences can result in varying refund amounts between members.

What happens if I move or cancel service?

Even if you move or cancel your service, you’re still eligible to receive any future capital credit retirements. Since the retirement process can take several years, it’s important to keep your contact information up to date. Please be sure to notify us of any address changes, so we can ensure you receive your payouts when they’re issued.

What happens if I pass away before receiving my capital credits?

If a member passes away before receiving their capital credits, the funds don’t disappear—they can still be claimed. The first step is to provide Green Hills with the member’s death certificate. If there’s a beneficiary on file, that person(s) will receive the capital credits. If no beneficiary is listed, family members will need to request a probate letter from Green Hills and go through the court process to determine who receives the funds. This can take up to 3 months, so it’s important to keep your beneficiary information up to date. Request a Beneficiary Form

Why is it important to have a beneficiary form on file?

We urge all of our members to have a beneficiary form for each account. Having a beneficiary form on file—and keeping it up to date—protects your wishes, simplifies the process for your loved ones, and avoids potential legal and financial complications. It’s a simple yet powerful tool in estate planning.

- Ensures Assets Are Distributed as Intended: A beneficiary form designates who will receive specific assets upon your death. Without one, these assets may not go to the person or people you intended, as they may be distributed according to state laws or default rules.

- Avoids Probate Delays: Assets with a designated beneficiary typically bypass the probate process. This can save time, reduce legal expenses, and allow beneficiaries to access funds more quickly.

- Simplifies the Process for Loved Ones: Designating a beneficiary prevents confusion or disputes among family members. It provides clear instructions, reducing stress during an already emotional time.

- Reflects Life Changes: Regularly updating beneficiary forms ensures they reflect your current intentions. Events like marriage, divorce, the birth of a child, or the death of a previous beneficiary make it essential to review and update these forms.

- Avoids Default Beneficiaries: If no form is on file, institutions may assign a default beneficiary (such as the estate). This can complicate the process, leading to unnecessary legal hurdles and unintended consequences.

Designating a beneficiary is simple! Contact Green Hills at 800-846-3426 or click here to request a beneficiary form. After completing & notarizing the form, return it to us, and we’ll upload it to your account for future reference.

How do I designate a beneficiary?

Designating a beneficiary is simple! Contact Green Hills at 800-846-3426 or click here to request a beneficiary form. After completing & notarizing the form, return it to us, and we’ll upload it to your account for future reference. Green Hills Communications has notaries on staff for the purpose of notarizing beneficiary forms if needed.

Does a Will & Testament override the beneficiary form?

No, the beneficiary form is specific to Green Hills Telephone capital credits, so it would override any Will & Testament left by the deceased member.

Is a Will & Testament sufficient to process the estate payout?

No. If a beneficiary has not been designated, the members’ estate must go through probate, even if a valid Will & Testament exists ” – a Will & Testament is broad and does not specifically mention Green Hills Telephone’s Capital Credits. The probate process will determine the legal recipient of the capital credits.

Can a Power of Attorney (POA) or Dual Power of Attorney (DPOA) complete a beneficiary form on behalf of a member?

If you hold Power of Attorney for a member who is still living, you may complete and sign the beneficiary form on their behalf. The appropriate signature format is: “Member’s Full Name by Your Name – POA.”

Please note that Power of Attorney authority terminates upon the member’s death. If the member is deceased, the POA is no longer valid. Payouts must proceed through probate to determine the rightful recipient of any capital credits if no beneficiary is on file.

Are capital credit disbursements taxable?

Annual capital credit disbursements are usually not taxable unless they go to an estate or exceed $600. In that case, a 1099-MISC form will be issued to you. For specific tax-related questions, we recommend consulting a tax professional.

I saw my name on the unclaimed capital credits list. What do I need to do?

1. Contact Green Hills Communications.

2. Green Hills will ask you some questions to verify your identity.

3. If everything agrees with what we have on file, the payment will be processed.

4. If the amounts shown on the unclaimed capital credits list are not claimed within 60 days of publication, the money will be redistributed to current members when the allocation process is completed for that year.

What happens if a member passes away?

1. Contact Green Hills Communications

2. Provide a copy of the deceased’s death certificate

3. Green Hills will determine if the account has a sole or joint membership

Sole Member

- If there is a beneficiary on file, each beneficiary will need to complete a W-9. Then a copy of the W-9s, death certificate and beneficiary form will be presented at the next board meeting for payout approval. Once approved, accounting will issue a check to the beneficiary(s).

Joint Member

- Both members must pass away before a payout can be processed

- The surviving member will need to complete a transfer of ownership form, transferring the capital credits over to their name as the sole member. Call 800-846-3426 or click here to request a transfer of ownership form.

- Green Hills will then transfer all services & capital credits over to the remaining member, so they can continue to receive the annual payouts.

- The new member may want to update the beneficiary on file. Please contact our office at 800-846-3426 to obtain a copy of the current beneficiary and update it accordingly or request beneficiary form.

What do I do if I get a divorce?

1. Contact Green Hills Communications

2. Green Hills will determine if the account has a sole or joint membership.

Sole Member

- Nothing needs to happen with the capital credits. We would just need to remove the ex-spouses’ name from the service account.

Joint Member

- Both members would need to complete a Division of Capital Credits form. Once complete, the capital credits will be split between both members & uploaded to their new sole member account.

- Services will be transferred over to one of the members & a new service account will be created for the other member.

- If you had a beneficiary form on file, please contact our office at 800-846-3426 or click here to obtain a copy of the current beneficiary form and update it accordingly or request a beneficiary form.

- If either/or members are moving outside the cooperative area, the capital credits will remain in their sole account & checks will be distributed, as usual. It is the responsibility of the members to keep their mailing address on file up-to-date.

What do I do if I get married?

1. Contact Green Hills Communications

2. Green Hills no longer offers joint memberships

3. If you marry someone who is already a member, then the membership will remain in their name. However, the member may want to update their beneficiary form on file by requesting a beneficiary form.

4. If the member’s name is changing, then that member will need to complete a Transfer of Ownership form. Request transfer of ownership form by calling 800-846-3426 or click here.

My business has closed and is no longer in operation. Can I collect my capital credits?

Once official documentation has been filed with the state confirming that your business is no longer in operation, the capital credits associated with the business account will be reallocated among the remaining stockholders. These credits will then be transferred into their individual personal membership accounts. Please note that for business accounts, capital credits are not paid out directly but are instead rolled over into qualifying residential accounts held by the stockholders.

Form Request

If you need to request a Beneficiary or Transfer of Ownership From, please submit your information below. We will be in contact to get you the appropriate form. If we have any questions, a representative will reach out to you directly. Please note that the beneficiary form must be signed in the presence of a notary. For your convenience, Green Hills has a notary available, if needed.